Our Mission

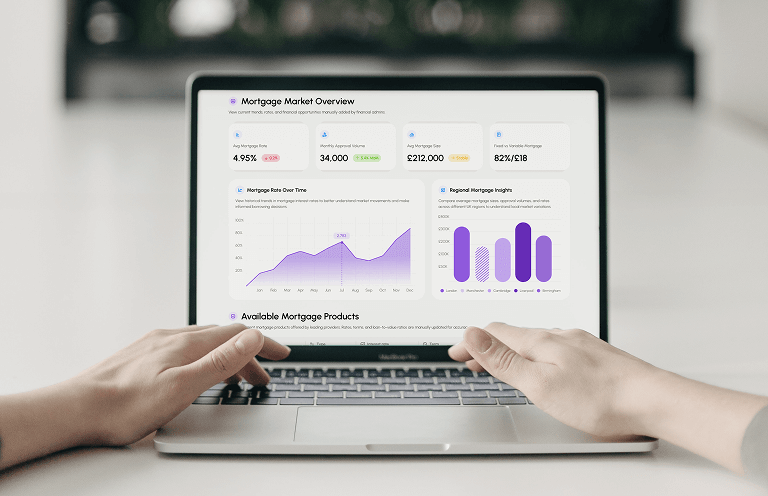

Smartlayer is transforming home finance. We’ve created the Smart Home Data Grid - an open, real-time infrastructure that integrates financial data, energy usage, IoT signals, behavioral patterns, and sustainability metrics. With this 4D data model, Smartlayer delivers the next generation of dynamic home finance products.

What do we build?

Smartlayer provides secure APIs, analytics, and compliance-ready infrastructure to support homeowners in building smarter products around this new data ecosystem.

that evaluates a home’s quality, livability, and long-term value.

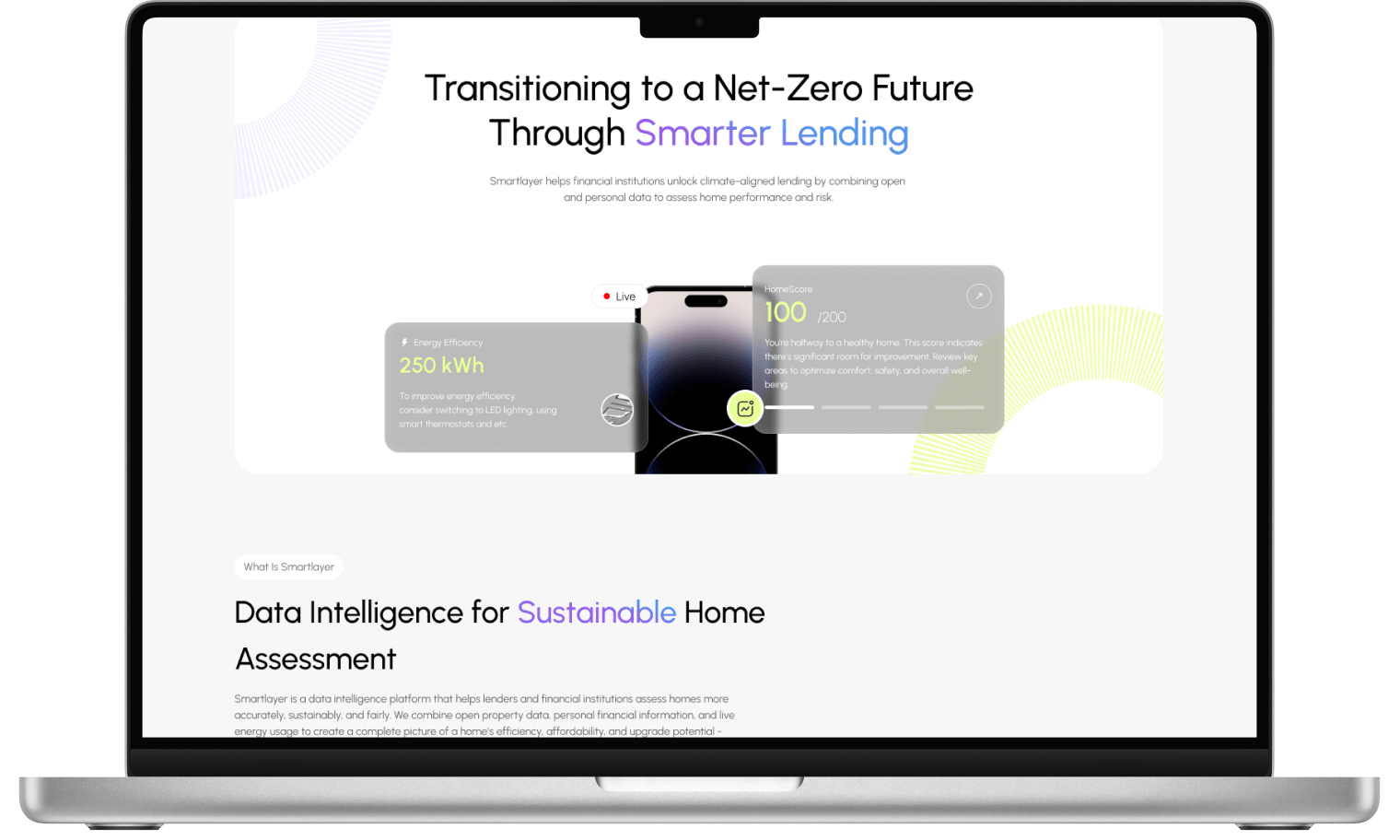

A unified dashboard built for modern banks, combining real-time insights on property performance, borrower behavior, and risk signals. LenderView aggregates verified data across energy usage, insurance, financial obligations, and home metrics — empowering smarter decisions, enhanced credit models, and more inclusive lending.

Why does it matter?

Mortgage lending is lagging in responsiveness and insight. Traditional credit scoring and property appraisal are outdated - they delay decisions, overlook key risk drivers, and ignore sustainability realities. Smartlayer changes that:

Integrates real-time insights to move underwriting from weeks to minutes.

Consolidates verifiable data while maintaining rigorous privacy standards.

Enables lenders to adjust offers based on a homeowner’s behavior, sustainability profile, and property details.

The Smartlayer Engine

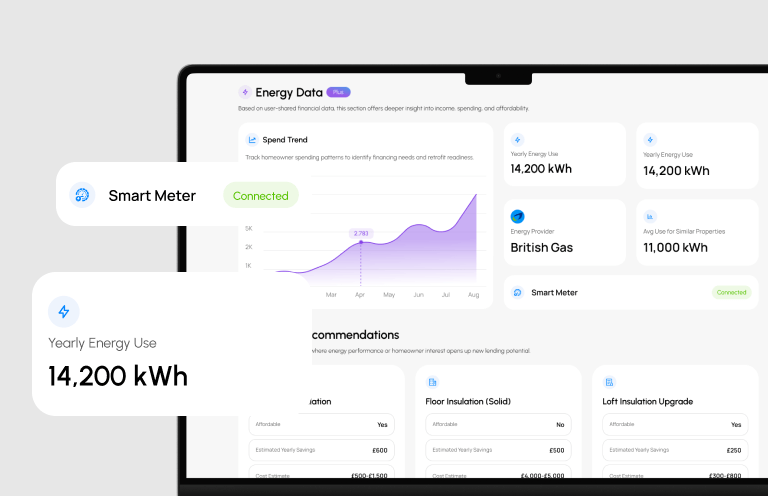

Our platform connects open data with user-consented insights to create an enriched mortgage

dataset - designed to minimize risk and maximize impact.

Consolidate

Open Data

1

EPC

Land registry data

Property surveyor report

Zoopla

Geo location data

Geo fencing data

Apply

Intelligence

3

Enriched Bank Mortgage Book

Identify

Opportunities

4

Action targeted financial

products opportunities

Augment with

Personal Data

2

Open Banking

Bank Statements

Affordability

Open Energy

Live Energy Usage

User validation

Smartlayer partners with forward-thinking banks to deliver faster underwriting, deeper borrower insights, and new product capabilities - all powered by real-time, property-specific data. With Homescore, you can lend smarter, reduce risk, and lead the market in financial innovation.